Rush Street Interactive is the latest US online gambling operator to announce plans to go public.

Rush Street Interactive (RSI) is set to go public on the New York Stock Exchange (NYSE) after announcing a reverse merger with dMY Technology, a special purpose acquisition company.

Once the deal is complete, RSI will join DraftKings, Golden Nugget, and GAN in going public in the US.

Merger details

The merger, which was unanimously approved by the boards of both RSI and dMY is expected to close later this year. Upon the completion of the merger, RSI trade on the NYSE under the RSI ticker with an initial enterprise venue value of around $1.78bn.

The deal still requires approval from dMY’s stockholders and is subject to other customary closing conditions and regulatory approvals.

RSI’s initial enterprise value of $1.78bn is 5.6 times larger than the operator’s projected revenue for the 2020/21 financial year, which sits at $320m. According to the investor presentation, RSI expects to generate between $1.5bn and $2.3bn in annual revenue.

RSI’s leadership will remain the same once the deal is complete, with Neil Bluhm as chairman, Greg Carlin as CEO and Richard Schwartz as president.

RSI chief executive Greg Carlin said: “We started RSI in 2012 to create a fun and engaging online experience for the US gaming customer and we now have a great opportunity to accelerate our growth in this dynamic market. We are looking forward to investing further in market expansion, product innovation, and growing our talented team.”

dMY’s chief executive Niccolo de Masi, said: “With their dozens of years of online casino and sports wagering experience, RSI has developed a leading customer-focused online gambling platform. Harry and I are tremendously excited about RSI’s positioning and the long-term growth opportunity they have in the expanding US market.”

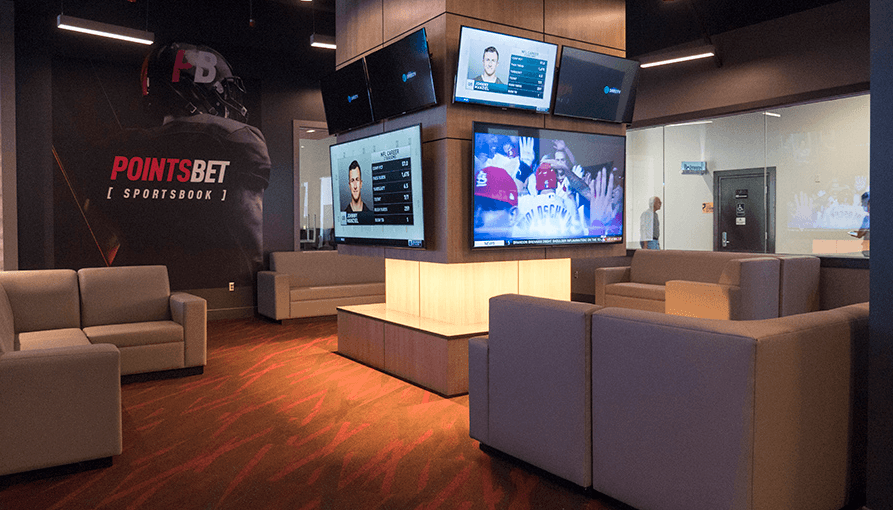

RSI, which is part of Rush Street Gaming, operates the BetRivers sportsbook and the PlaySugarhouse online casino brand. BetRivers was the first operator to take land-based and online bets in Illinois and was the first online operator to serve the state of Indiana. RSI also offers sports betting services in New Jersey, Pennsylvania and Colorado.

Neil Bluhm, chairman of RSI’s board of directors said the deal would provide the business with the capital necessary to continue its US expansion.

RSI president Richard Schwartz said: “RSI has achieved leading online casino and sportsbook market positions by focusing on what players want – a high-quality product, helpful customer service, and transparency and honesty. This transaction will help enhance and broaden our product offerings and attract more players.”

US operators going public

Once the deal is complete, RSI will join the likes of DraftKings, GAN and Golden Nugget, in trading publicly in the US.

Towards the end of April, Diamond Eagle Acquisition Corp (DEAC) shareholders approved the merger between DraftKings and SBTech and the public listing of the new entity, DraftKings Inc. From 24 April the company began publicly trading on the Nasdaq under the DKNG ticker symbol.

Last month, Golden Nugget Online Gaming, the online arm of the Golden Nugget casino chain, announced plans to go public on the Nasdaq exchange with an estimated valuation of $745m.