On Wednesday, the international law firm CMS held its annual gambling conference in London. The event featured several high-profile speakers from all corners of the gambling sector.

The event kicked off with a keynote speech delivered by the Gambling Commission’s Chief Executive, Neil McArthur, outlining three key aspects that the industry has to consider. McArthur outlined how there is now more of a focus on consumers and the ways in which they gamble, operators and their representatives are changing, and that regulation is constantly changing.

After summarizing the most recent developments in 2020 so far, such as the ban on credit card gambling, the Commission’s new initiative to create three working groups and the Murdoch letters, McArthur reminded listeners that operators need to adopt a “single customer view,”. He added that as technology changes there will always be a level of risk for players, but also opportunities to find new ways to help them.

“Changes in consumer behaviour and technology will continue to create new risks to consumers and new opportunities to keep them safer. Taking those opportunities will need us all to take risks. Not everything will work. Nothing will be acclaimed or praised until there is clear evidence that it is having a true impact,” Said McArthur.

McArthur ended his speech by emphasizing the importance of working together. “I and my colleagues at the Commission stand ready to work with anyone who shares our determination to make gambling safer. If we work together, I am sure we can do that,” said McArthur.

The keynote was followed by several panels, each tackling a different issue facing the gambling sector and provided us with an opportunity to hear different perspectives and learn from one another. So, what were the key points to take away from the conference? Let’s find out.

Putting the consumer first

This panel featured, Richard Flint, former Chairman, SkyBet, Brigid Simmonds, Chair, Betting and Gaming Council and Ivor Jones, Equity Analyst at Peel Hunt and looked at how to build a strong industry in an age of paternalism.

Richard Flint kicked off the panel by stating that due to the nature of the gambling products, it’s hard to get consumers to defend the industry. Brigid Simmonds added that there is an “in-built snobbery around gambling,” and said it needs to change. The panellists agreed that the industry is politically naïve and that the upcoming government review was inevitable.

When it comes to problem gambling and overspending on the part of vulnerable players, the panellists questioned the responsibility of the financial institutions that provide players with money. The operators and the financial sector need to work together to figure out where player money is coming from. There is also the view that online gambling is a very isolating experience and the speakers agreed that this must change.

Ultimately, the panellists’ discussion boiled down to a handful of key areas that the industry must work on. Operators have an obligation to interact with customers and identify how they spend money. The sector must work with banks and charities and other parties to root out problem gambling and most importantly, operators need to care for their customers.

Identifying and interacting with problem gamblers

On this panel, speakers discussed the challenges that come with identifying problem gamblers and the various ways in which operators interact with them. Panellists included representatives from BetBuddy, GamCare, William Hill, Flutter Entertainment and Spreadex.

Anna Hemmings, Chief Executive of GamCare, said that it is essential to look at a customer’s journey to help to identify warning signs that they may suffer from a gambling problem. All of the panellists agreed that the use of player data is the most effective way to go about identifying vulnerable players.

When asked about the possibility that data could be used to profile players, Simo Dragicevic, Chief Executive of BetBuddy, said: “you are profiling them, it is segmentation. GDPR laws shouldn’t act as a deterrent.”

Joanna Simon, Compliance Officer at Spreadex said that the behavioural indicators are important but operators need to be in constant communication with players from the start of the player’s journey if they wish to build a trusting relationship.

The main takeaway is that, at its heart, communicating with problem gamblers is always going to be a challenge as it’s a complex human issue. Players aren’t always going to respond the same way so operators must build a level of trust with players.

Lauren Hilton, Group Compliance Director, William Hill, reiterated that training and understanding is critical to understanding such a complex issue and believes that operators must engage in a conversation with customers. Tanya Horgan, Group Chief Risk Officer, Flutter Entertainment said: “the more personalized it is, the better you can address the behaviour.

What does good regulation look like?

This panel consisted of representatives from the Lotteri-og Stiftelsestilsynet (Norwegian Gaming Authority), the KSA (Netherlands Gaming Authority), the Government of Gibraltar Gambling Division, Spillemyndigheden (the Danish Gaming Authority) and the MGA (Malta Gaming Authority). The discussion centred around what strong regulation looks like and how regulation can affect the market.

Andrew Lyman, Executive Director, Government of Gibraltar Gambling Division, said that although their regulation shares similarities with the UK, it is not as flexible, and this is something that needs addressing. Rene Jansen, Chairman of the KSA, highlighted the need for a more “principle-based model” that can guide the market on the principle that consumers can find responsible operators.

Each speaker highlighted the need for a flexible regulatory framework that is comprehensive, robust and places the consumer first. The panellists also noted that operators have never really been ahead of the regulatory curve and that they need to get out ahead if they wish to change the public’s negative perception of gambling.

Birgitte Sand, Chief Executive of Spillemyndigheden, said “we need to play less cat and mouse and work together,” echoing Neil McArthur’s message that the industry’s operators and regulators need to work together to succeed. Birgitte ended the panel by saying “we need to be global in our thinking.”

The horseracing funding model

This panel centred around the funding challenges facing the UK’s racing industry and included, Richard Ames, Chief Executive, Sports Information Services, Simon Bazalgette, former Group Chief Executive, The Jockey Club, Alan Delmonte, Chief Executive, Horserace Betting Levy Board, Phil Siers, Chief Commercial Officer, Betfred and Alastair Warwick, Chief Operating Officer, Ascot Racecourse.

While the issue of how to fund horseracing is nothing new, panellists discussed the risks associated with moving to a turnover based model as well as the opportunity to adopt a hybrid model which uses media rights and funds from the horserace betting levy.

Richard Ames believes that a turnover based model would not work, based on the current model being used by Australia’s horseracing industry. This sentiment was echoed by Phil Siers who strongly believes a turnover model would be regressive for the industry and that a combination of the horseracing levy and media rights is the best way to go about funding the sport.

One thing’s for sure, all of the panellists agreed that there is a symbiotic relationship between betting and the horseracing industry and that more collaboration is required if the industry is going to find an ideal solution to the funding issue.

Data rights

The discussion on data rights included Andrew Ashenden, Chief Betting Officer, Stats Perform, Adrian Ford, General Manager, Football DataCo , David Lampitt, Managing Director Sports Partnerships, Sportradar and Michael Short, Vice President & Counsel, IMG Sports.

The panel briefly outlined their surprise that the betting industry has come under so much fire in the press recently and stated how important sports and betting are to one another. From here, the discussion moved into the pitfalls of collegiate sports in the US market. Ultimately it is up to governing bodies in different jurisdictions to monitor and regulate collegiate sports betting. David Lampitt also stated that data companies have a very clear bar for what kind of data they provide and that engaging with the data is the best way to retain a level of control.

Shortly after this, the panel descended into a shouting match over the correlation between the integrity of sports and the use of unofficial data. Adrian Ford said: “official data is truth. Unofficial data may not be right, this puts the consumer at risk.” With the exception of David Lampitt, all speakers agreed that there should only be one source of data.

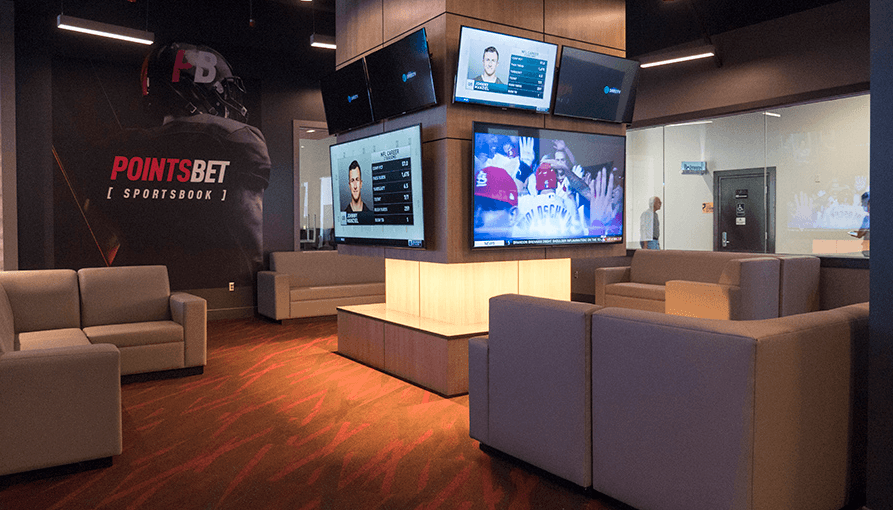

US sports betting

The panel on the US sports betting market included David Briggs, Chief Executive of GeoComply, Charles Cohen, Vice President of Sports Betting at IGT, Adam Greenblatt, Chief Executive of Roar Digital, Jeffrey Haas, Chief International Officer at DraftKings, Ramy Ibrahim, Managing Director of Moelis and Jeremy Kleiman, Partner at Saiber.

After setting the scene in the States, the panellists moved onto the regulatory environment and explained that some states, such as Ohio, are seeing a lot of regulatory infighting over who will get to control sports betting. Jeffery Hass also highlighted how regulators are becoming much more sophisticated and are paying much more attention to data to help make regulatory decisions. There is also a consensus that players are becoming more educated on sports betting and that operators will need to tailor their product specifically to different states.

While each panellist praised the success of New Jersey, Pennsylvania and Indiana’s betting markets, they also believe that this is just the first wave and that in the coming months and years the sports betting landscape is going to change drastically.

The speakers were all in agreement that FanDuel and DraftKings are the two most likely operators to become household sports betting names but there is still competition from operators such as MGM, William Hill, Bet365 and Fox Bet, as these operators have yet to turn on their marketing machines.

Ramy Ibrahim believes that success in the market will come down to having a strong product and providing the best user experience. “Product will win,” said Ibrahim. Adam Greenblatt went a step further and said he believes that in the next three years we will begin to see at least five serious players with a national footprint.

David Briggs also reminded the audience that it’s not only the operators who are winning, but also the taxman and the local communities in the states with legal betting that are benefiting from extra tax revenue from sports betting. The advertising sector is also booming as operators are doubling down on marketing efforts, but most importantly, this is a win for the entire US gaming industry.